-

Annual Report & Accounts 2021

Highlights of 2021

-

RUB58.5bln

6%

Adjusted Revenue in 2021

RUB29.0bln

8%

Adjusted EBITDA in 2021

32%

Net Debt reduction to RUB 18.5 bln at year-end 2021 vs. the end of 2020

50%

Adjusted EBITDA Margin in 2021 (2020: 49%)

RUB16.1bln

7%

Free Cash Flow in 2021

0.6x

Net Debt to Adjusted EBITDA

at year-end 2021 (2020 end: 1.0x) -

-

Strong market recovery

- Significant H2 market recovery with overall Russian freight rail turnover at an all-time high in 2021 driven by robust bulk cargo demand.

- Recovery in gondola market rates starting in late Q2 2021 continued in H2 2021, with 2021 bulk cargo volumes exceeding pre-COVID levels; tank market pricing remained robust with volume recovery accelerating in H2 2021.

-

The Group’s Freight Rail Turnover growth resumed in H2

- The Group’s Freight Rail Turnover returned to growth in H2 2021, rising 8% on H1 2021, with full-year Freight Rail Turnover 2% lower year on year.

- Two key service contracts extended in 2021 – Rosneft for 5 years and Metalloinvest for 2 years (with higher service volumes agreed).

- Average Price per Trip rose 11% year on year in 2021, reflecting a recovery in gondola market rates in H2 2021 with continued solid pricing in the oil products and oil segment.

- Growing demand for Globaltrans’ services drove the expansion of the Leased-in Fleet of gondolas and underpinned the purchase of tank cars.

- Gondola Empty Run Ratio further improved to 44% (2020: 45%) – one of the lowest in the Russian market.

-

increased profitability supported by cost control; strong Free Cash Flow supported deleveraging

- Adjusted Revenue rose 6% year on year to RUB 58.5 billion on the back of the recovery in gondola rates in H2 2021 coupled with continued robust pricing in the tank car segment.

- Total Operating Cash Costs were held in check contributing to an increase in the Adjusted EBITDA Margin to 50% in 2021 comparing to 49% in 2020.

- Adjusted EBITDA rose 8% year on year to RUB 29.0 billion.

- Strong Free Cash Flow increased 7% year on year to RUB 16.1 billion despite a 22% increase in Total CAPEX to RUB 8.4 billion following purchases of tank cars and increased Maintenance CAPEX.

- Net Debt reduced 32% in 2021 to RUB 18.5 billion compared to the end of 2020; leverage was at a low level with Net Debt to Adjusted EBITDA at 0.6x compared to 1.0x at end 2020.

- All the Group’s debt has fixed interest rates and is denominated in roubles.

-

Robust above-target Interim 2021 dividends delivered; final 2021 dividend on hold

- Improving dividend capacity over H1 2021 with gondola prices recovering enabled payment of above-target Interim 2021 dividends (regular and special) of RUB 4.0 billion or RUB 22.50 per share/Global Depositary Receipt ("GDR") in September 2021.

- Final dividends for 2021 temporarily suspended in April 2022 due to both technical limitations regarding upstreaming cash to the Cyprus holding company and the objective of establishing liquidity buffers.

-

-

Chairman's Statement

It was a year of rapid recovery for Globaltrans and for the Russian rail freight sector. The strength of the global economic rebound created overwhelming demand for freight logistics, driving overall Russian freight rail turnover to an all-time high.

Sergey Maltsev

Chairman of the Board,

Chief Strategy Officer,

Co-founder and shareholder

of GlobaltransIn such volatile markets, the robustness of Globaltrans balanced business model focused exclusively on bulk cargoes and oil products and oil, was again evident. The business was quick to benefit from the industry’s rapid resurgence in the second half of the year.

See More

Globaltrans delivered strong financial results and met its operational and strategic goals in 2021. Our full year results were strong thanks to an impressive second half performance that compensated for a weak first half. Adjusted Revenue of RUB 58.5 billion, Adjusted EBITDA of RUB 29.0 billion and a Profit for the year of RUB 15.1 billion were all ahead of the previous year. Free cash flow generation remained robust, with the Group’s Free Cash Flow up 7% year on year to RUB 16.1 billion, our cost control was exemplary and we achieved further deleveraging with Net Debt to Adjusted EBITDA at 0.6x. -

CEO Review

Dear Shareholders,

Thanks to the underlying strengths of Globaltrans, we were able to deliver an excellent performance in 2021. We achieved strong financial results with another year of disciplined operational performance despite market volatility and the ongoing impact of COVID-19.Valery Shpakov

Chief Executive Officer

In the reporting year, we generated good momentum focused on our core competencies of superior service, operational excellence, cost management, and prudent capital allocation. We deepened our customer engagement, secured important contract extensions with major customers, expanded our leased-in gondola fleet to satisfy strong demand for our services, maintained our efficiency, and optimised our portfolio by divesting non-core asset. From a results standpoint, 2021 was definitely a year of two halves. The first half was impacted by sustained weakness in gondola market rates for most of the period. However, gondola rates staged a prolonged recovery between May and December, supported by buoyant demand in bulk cargoes. Consequently, Globaltrans’ financial performance in the second half rebounded strongly with the result that FY2021 key financials were ahead of the previous year.

See More

-

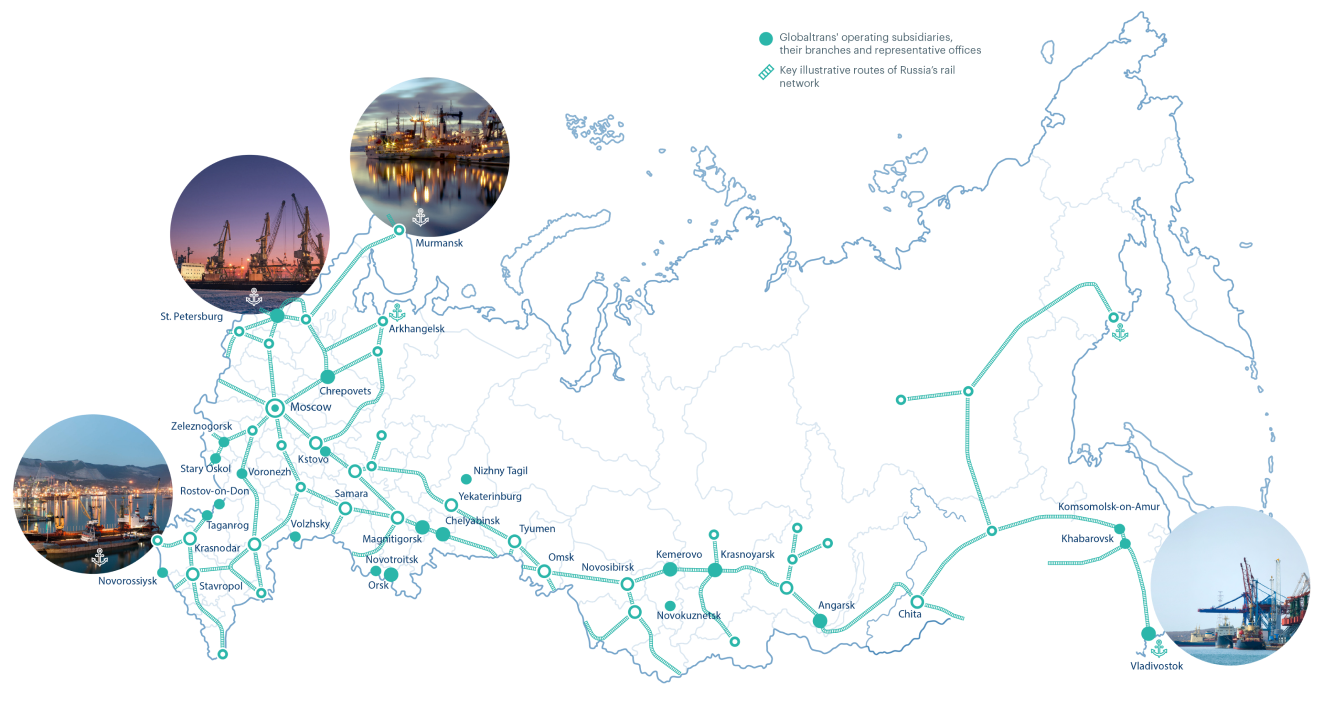

Who we are

-

Robust business model and efficient operations

- Strong positions in key freight rail segments of metals and oil products and oil

- Diversified blue-chip customer portfolio underpinned by long-term service agreements

- Industry-leading operational efficiency

-

Entrepreneurial culture combined with best-in-class governance

- Founded and led by entrepreneurs with a focus on quality and innovation

- Experienced Board and management team

- Adherence to best-practice governance standards

- Sustainable business with a strong ESG focus

- Dual-listed on the London Stock Exchange and the Moscow Exchange

-

Financial stability and strength

- High proportion of multi-year outsourcing contracts

- Robust balance sheet

- Strong Free Cash Flow generation

- Significant liquidity available

-

Focus on shareholder returns

- Track record of delivering consistent dividends and achieving dividend targets, transparent dividend policy, semi-annual dividend payments

- Ongoing share buyback programme capable of providing support during market volatility

-

-

How we deliver value

-

Sophisticated logistics

- We are experts in managing complex freight logistics that improve our customer's productivity, saving them time and money.

-

Sector-leading operational efficiency

- Our centralised gondola dispatch hub is the nerve centre of our railcar operations. Working around the clock, it keeps our fleet running smoothly, maintains high utilisation levels and low Empty Runs, delivering efficiency which in turn drives profitability.

-

High-quality long-term client base

- We are trusted partners for our clients, ranging from major industrial groups to smaller, more specialised companies. We focus on long-term outsourcing partnerships, whereby we manage most of a client’s freight rail logistics. Our clients benefit from operational scale, 24-hour services, advanced logistics, and access to one of Russia’s largest fleets.

-

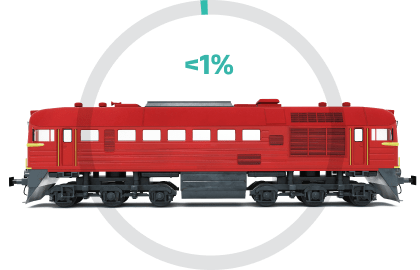

In-house locomotives improve productivity

- Our in-house locomotive fleet transports oil products and oil in block trains where all the cargo is bound for a single destination, obviating the need to stop at multiple sorting stations, improving delivery schedules and fleet utilisation.

-

-

Our Industry

3rd

largest rail network globally connects the world's largest country across its 11 time zones

Vital

industry connecting Russian regions and linking Russia to the global economy

87%

of the Russia's overall freight turnover, excluding pipeline traffic, travels by rail

2.6tn

Overall Russia's freight rail turnover in 2021 (tonnes-km)

Sustainable choice

most eco-friendly means of long-distance freight transportation over land

88%

of Russia's total railcar fleet controled by private players

Structural

growthdrivers supported by government investment in rail infrastructure to expand the Far East rail corridor

-

Our Assets

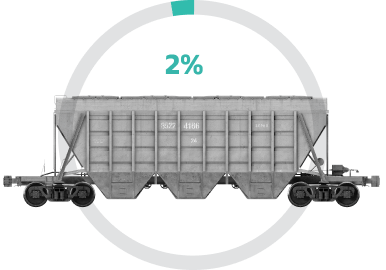

GONDOLA CARS

47,775

units

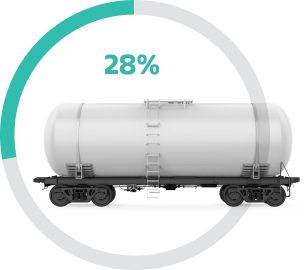

TANK CARS

19,587

units

OTHER RAILCARS

1,673

units

LOCOMOTIVES

71

units

Financial and Operational Review

-

-

Globaltrans delivered excellent results in 2021 converting a favourable market environment into a strong financial performance. Our robust financial position was made even stronger as we further reduced our Net Debt, all of which is in the local currency with fixed interest rates. I believe we are well positioned to weather what lies ahead.

Alexander Shenets

Chief Financial Officer

-

-

-

-

DIVIDENDS

Robust above-target interim 2021 dividends delivered; final 2021 dividend on hold

- Improving dividend capacity over H1 2021 with gondola prices recovering enabled payment of above-target Interim 2021 dividends (regular and special) of RUB 4.0 billion or RUB 22.50 per share/GDR in September 2021.

- Final dividends for 2021 temporarily suspended in April 2022 due to both technical limitations regarding upstreaming cash to the Cyprus holding company and the objective of establishing liquidity buffers.

-

FINANCIAL RESULTS

Increased profitability as costs controlled; strong Free Cash Flow supported successful deleveraging

- Adjusted Revenue rose 6% year on year to RUB 58.5 billion on the back of the recovery in gondola rates in H2 2021 coupled with continued robust pricing in the tank car segment.

- Total Operating Cash Costs were held in check contributing to an increase in the Adjusted EBITDA Margin to 50% in 2021 compared to 49% in 2020.

- Adjusted EBITDA rose 8% year on year to RUB 29.0 billion.

- Strong Free Cash Flow increased 7% year on year to RUB 16.1 billion despite a 22% increase in Total CAPEX to RUB 8.4 billion following purchases of tank cars and increased maintenance CAPEX.

- Net Debt reduced 32% in 2021 to RUB 18.5 billion compared to the end of 2020; leverage was at a low level with Net Debt to Adjusted EBITDA at 0.6x compared to 1.0x at end 2020.

- All the Group’s debt has fixed interest rates and is denominated in roubles.

-

-

-

OPERATIONAL PERFORMANCE

Freight Rail Turnover growth resumed and gondola rates recovered amid growing demand for Globaltrans’ services

- The Group’s Freight Rail Turnover (excluding Engaged Fleet) returned to growth in H2 2021, rising 8% on H1 2021, but could not fully compensate for the weather-related delays, congestion at key client facilities and sluggish demand in the oil products and oil segment seen in H1 2021 with full-year Freight Rail Turnover 2% lower year on year.

- Average Price per Trip rose 11% year on year in 2021 reflecting a recovery in gondola market rates in H2 2021 with continued solid pricing in the oil products and oil segment.

- Total Empty Run Ratio (for all types of rolling stock) was unchanged year on year at 51%.

- Growing demand for Globaltrans’ services drove the increase in the number of leased-in gondola cars with 2.2 thousand units added and underpinned the purchase of 381 tank cars, with 197 delivered in 2021. The remainder was delivered in March 2022 along with an additional 119 tanks cars acquired in early 2022.

- Gondola Empty Run Ratio further improved to 44% (2020: 45%) – one of the lowest in the Russian market – reflecting continued adjustments to cargo and client mix due to the ongoing impact of the COVID-19 pandemic.

- Total Fleet declined 4% or 2,582 units to 69,106 units as of the end of 2021 largely reflecting the sale of the specialised container operator SyntezRail in October 2021. The average age of the Group’s Owned Fleet was 13.8 years as of the end of 2021.

-

Robust client retention with successful key contract extensions in 2021

- Strong portfolio of service contracts contributed 59% of Net Revenue from Operation of Rolling Stock in 2021.

- These long-term service contracts provide for better volume visibility and lower pricing volatility and enable logistical efficiencies.

- Two key service contracts were successfully extended in 2021:

— Rosneft for 5 years to the end of March 2026.

— Metalloinvest for 2 years to the end of 2023 with serviced volumes increased to approximately 70% of Metalloinvest’s freight rail needs from 50% previously

-

Sustainability

-

-

Clear governance

- Oversight from the ESG Board committee

- Transparent reporting of key metrics

-

Sustainable business practices

- Embedding sustainability in our way of working and business mindset

- Minimising our impact on the environment

- Improving energy efficiency

- Reducing carbon emissions

-

Positive social impact

- Focus on employee development

- Providing support to our communities

-

-

ESG

Committee formed

to guide Globaltrans’ ESG agenda

2.6x

increase in training hours

largely attributable to safety training

Scope2

emissions

First time reporting

ReinforcedESGdisclosure

with the publication of the Integrated Report, ESG Data Book and TCFD Report

LTIFRZERO

Improved safety performance with Lost Time Injury Frequency Rate (LTIFR) falling from 0.66 to zero while business continuity maintained throughout the COVID-19 pandemic

GPG-3%

First time disclosure of gender pay gap (measured at non-managerial level) - women earn on average 3% more due to greater proportion of women in highly skilled positions

Green

office initiative

Introduced

External

recognition

Further external recognition of the Group’s ESG efforts with improved rating by leading rating agency Sustainalytics